In the recent case of Colonial American Casualty and Surety Co. v. Scherer, -- S.W.3d --, 2007 WL 135969 (2007), a Texas appellate court ruled that a surety issuing an administrator's bond was not liable for attorney's fees in excess of the stated penal amount on the face of the bond. In that case, the stated penal sum was $30,000.

This case has some significance to California because while the Texas appellate court was applying Texas law, and was interpreting the language of the specific bond, the court cited numerous California cases in reaching its decision.

But yet a California court would probably still use a somewhat different approach given that the Bond and Undertaking Law [Cal. Code of Civil Procedure § 995.010] establishes a regime for asserting claims against bonds given in a proceeding, which would include probate matters. No matter what the bond provides there are avenues for seeking counsel fees from a surety on a "proceeding bond" if the surety fails to honor a claim in a timely manner [see Cal. Code of Civil Procedure § 996.480].

Thursday, February 22, 2007

Wednesday, February 21, 2007

1031 Exchange Problems

http://www.montecitojournal.net/archive/13/8/783/

http://www.scbar.org/pdf/SCL/Sep01/tharpe.pdf

http://www.scbar.org/pdf/SCL/Sep01/tharpe.pdf

Wolves in Experts' Clothing

California Governor Arnold Schwarzenegger has signed a bill making it more difficult to engage in reverse mortgage scams. Under Senate Bill 1609, reverse mortgage applicants will be required to receive independent advice concerning the pros and cons of the loan from an independent counseling agency. The agency would not have an interest in the loan transaction.

California Governor Arnold Schwarzenegger has signed a bill making it more difficult to engage in reverse mortgage scams. Under Senate Bill 1609, reverse mortgage applicants will be required to receive independent advice concerning the pros and cons of the loan from an independent counseling agency. The agency would not have an interest in the loan transaction.According to a September 6, 2006 Oakland Tribune article written by Becky Bartindale, the idea for the law came from a real-live incident of loan fraud:

The idea behind Senate Bill 1609 came from Shirley Hochhausen, managing attorney for Community Legal Services in East Palo Alto, as part of Simitian's annual "There Ought to be a Law" contest. Hochhausen proposed the measure after seeing too many clients such as Johnny Damon, 66, who is now at risk of losing his East Palo Alto home of 34 years.

Damon, who worked as a cement finisher for the city of Palo Alto, was sold a $200,000 reverse mortgage last September. Damon bought his home for about $50,000 in 1977, and it is now worth about $700,000.

But according to a lawsuit filed last month, the brokerage company arranged a traditional mortgage, unbeknownst to Damon.

So instead of receiving the income he was counting on, the suit alleges, Damon was stuck with monthly loan payments he cannot afford, and the president of the brokerage company absconded with $190,000 in loan proceeds.

Hat tip to Prof. Beyer for bringing this to my attention. Also, Julia Wei of the Dirtlaw Blog posted a good analysis of this statute on her blog.

Friday, February 16, 2007

Probate Assets vs. Non Probate Assets

Post death transfers of assets in California roughly fall into two categories: probate transfers, and so-called "non probate" transfers. An example of an asset which would probably require some sort of probate administration (i.e., constituting a probate asset) would be a piece of real property, for example, having a form of title such as "John Doe, a single man."

Post death transfers of assets in California roughly fall into two categories: probate transfers, and so-called "non probate" transfers. An example of an asset which would probably require some sort of probate administration (i.e., constituting a probate asset) would be a piece of real property, for example, having a form of title such as "John Doe, a single man."An example of a probable non probate asset (which would likely not require the intervention of a probate court) might be: "John Doe, a single man and Jane Roe, a single woman, in joint tenancy with right of survivorship." If Jane Roe were to die, for example, the property would immediately transfer to John (at the moment of her death) by operation of law.

To decide whether property is a probate or non-probate asset, ask yourself: Does the property have anywhere to go? In other words, without an order would the property automatically transfer to someone else? If the answer is "yes" (because some form of transfer already took place) then it is probably not a probate asset. On the other hand, if the property has "nowhere to go" otherwise, then it probably is a probate asset requiring administration.

This is a very general rule, however; there are exceptions. In California, for example, administration would not be required in the case of a small estate, even though the asset might be considered a probate asset. Also, a spousal property petition [Probate Code § 13502.5] is a form of a probate proceeding. But the proceeding is sharply abbreviated, and is essentially an order that probate administration is not required.

Tuesday, February 13, 2007

A Thoughtful Piece on Our Mortality

Professor Francine Lipman of Chapman University has written a touching essay entitled Celebrating Life (Chai) and Taxes: Lessons Learned (available in downloadable format) where she describes her experiences dealing with her mother's illness and death, on both an emotional and an estate planning level.

Professor Francine Lipman of Chapman University has written a touching essay entitled Celebrating Life (Chai) and Taxes: Lessons Learned (available in downloadable format) where she describes her experiences dealing with her mother's illness and death, on both an emotional and an estate planning level.While many estate and financial planners regularly deal with these problems on a "professional" level, living the problem -- as Prof. Lipman has done -- is something we will all face at one time or another. That is, if we live long enough to do it.

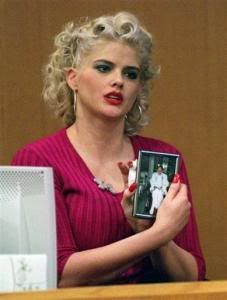

Lessons from Anna Nicole Smith: The Problem with Delaying Getting Your Financial House in Order

Believe it or not, there are some lessons in the death of Anna Nichole Smith, which occurred last week. In his blog, Professor Beyer gave a summary of what we currently know, and what we don't know, regarding her (at least, at this point) mysterious death:

Believe it or not, there are some lessons in the death of Anna Nichole Smith, which occurred last week. In his blog, Professor Beyer gave a summary of what we currently know, and what we don't know, regarding her (at least, at this point) mysterious death:She may not have had a will. It is unknown if Smith had a will; if she did, it is unclear what it provided. Therefore, if it is ultimately determined that she did not have a will, her assets would probably be disposed under the laws of intestacy -- this means that the money would be likely shared by her child, and husband (if it turns out that she was married, which is now an open question).

Was she married, or not? She may or many not have been married. The legal status of her relationship with Howard Stern is not clear.

She had an infant child. This speaks for itself.

She was likely quite rich -- and may have an expectancy. This also speaks for itself. Even though it is not currently a part of her estate, she had an expectancy from her deceased husband's estate in the sum of about $474 million -- give or take.What does this tell us? Here are some ideas:

1. It pays to be a "gold digger"...(just kidding -- well, maybe not...).

2. Her child has no clearly designated guardian. If Anna was without a will, her child has no clearly designated guardian. Although it is ultimately up to the court to decide this issue, Anna may have forfeited an important legal right in failing to have an effective will in place, to the detriment of her daughter.

3. Even if a person is without assets, wills are important. Most of us do not have an opportunity to receive $474 million. However, even young, relatively "poor" families should have an effective will to ensure that their children for the purpose of appointing guardians for their children. Also, financial circumstances do, indeed, change over time.

4. An outdated will is little better. If Anna had an outdated will, it would have been little better that no will. An outdated will would not necessarily have stated her current wishes, and could very well have contradicted those wishes. For instance, she apparently had a very flexible attitude about relationships. The fact that she apparently had many changes concerning her wishes over a short period of time is an even more important reason for a current will.

5. It doesn't pay to wait. I'm sure that Anna did not plan on dying at the age of 39.

Subscribe to:

Posts (Atom)